12वीं एकीकृत रेटिंग डिस्कॉम को उनकी समग्र विशिष्टता व खामियों के साथ-साथ उनके द्वारा सामना की जाने वाली चुनौतियों पर प्रकाश डालने में मूल्यवान होगी

Shri Krishan Pal Gurjar

Hon’ble Union Minister of State of Power and Heavy Industries

Government of India

The 12th Integrated Rating highlights the landmark progress made by the power distribution sector and provides future roadmap to stakeholders for achieving highest standards

Shri R.K Singh

Hon’ble Cabinet Minister of Power and New & Renewable Energy

Government of India

Comprehensive scorecard for every DISCOM with rating, ranking and trajectory

Ratings will be dynamic in nature, reviewed regularly for key triggers (e.g. audited accounts, default to banks etc.)

Metrics adjusted for actual cash received rather than accruals, e.g., ACS-ARR gap, DSCR, Leverage

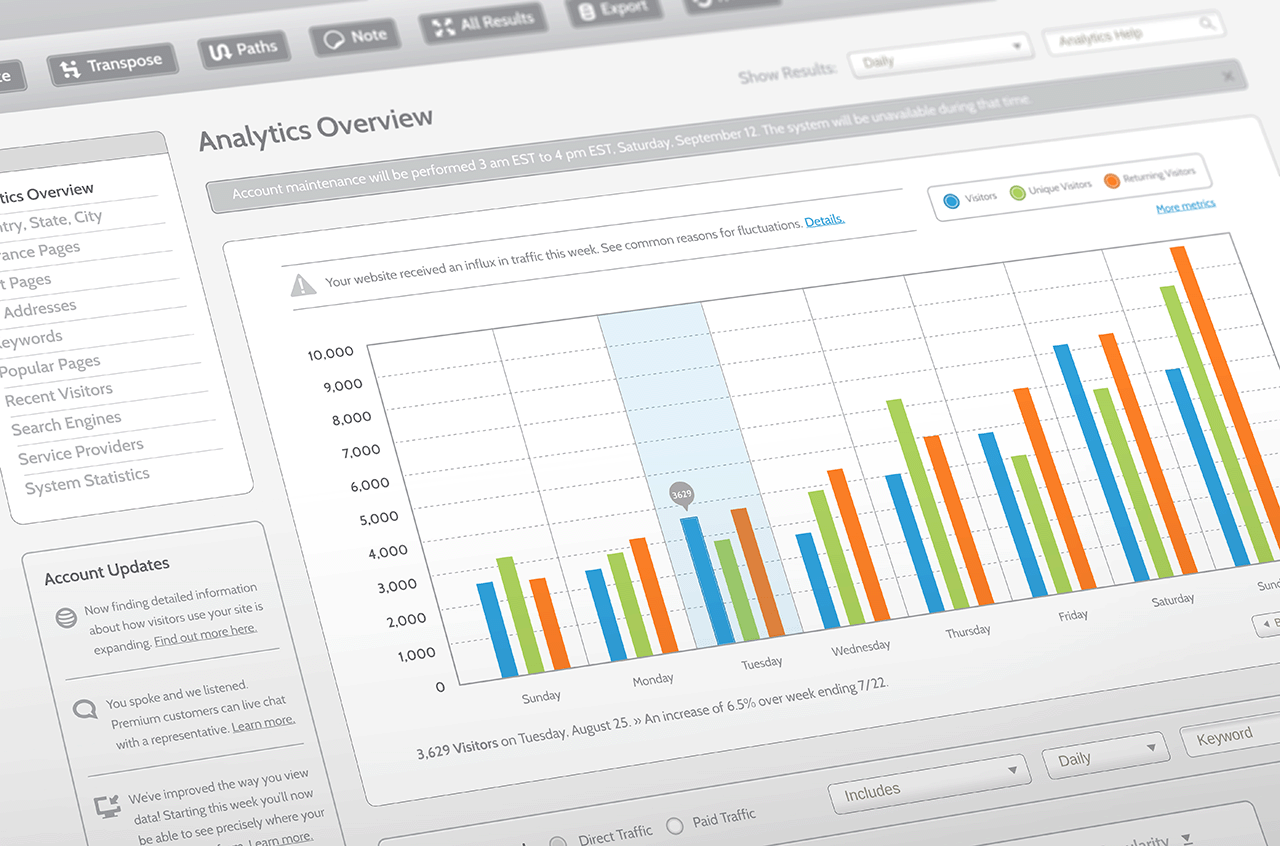

Interactive digital dashboard to view rankings, ratings, historical trends and benchmarking results

Ratings rely on available and verifiable data sourced from audited accounts, regulatory filings and orders, etc.

Robust analytics backed approach – weighted average of 3 years data (to normalize anomalies), ability to drill-down from rating dimension to specific metrices

Actionable for DISCOMs via specific root causes of under-performance and best practices for improvement